Better corporate employee benefits attract top talent

Insperity’s plan designs and long-term relationships with nationally recognized insurance carriers allow us to provide employees at midsize companies with access to cost-effective, comprehensive group health coverage.

Several health benefit offerings to satisfy individual needs.

- Multiple options

- Nationally recognized carriers

- Dental and vision coverage independent of medical

- Prescription coverage

Employees can save money each year with a flexible spending account.

- Eligible employees can pay for specific health care expenses using pretax dollars

- Employees decide how much to set aside each paycheck before taxes

- Employees can contribute up to $2,600 annually

- Funds may also be used toward expenses for eligible dependents

Employees at midsize companies can cover qualified health care expenses using a health savings account.

- Available to Insperity high-deductible health plan enrollees

- Money can be set aside through payroll deduction on a pre-tax basis

- Ability to make employer contributions

Team members will have peace of mind when the unexpected happens.

- Basic (employer-paid) and voluntary (employee-paid) options

- Coverage amounts are equal to an employee’s covered annual earnings

- Employees are covered anywhere

An extra cushion employees need when unforeseen events make it difficult to work.

- Basic (employer-paid) and voluntary (employee-paid) options

- Short-term disability coverage replaces 60% of an employee’s covered weekly earnings

- Long-term disability coverage replaces 60% of an employee’s covered monthly earnings

Improve the quality of employees’ lives both on and off the job.

- Assistance with emotional wellbeing, addiction and recovery, legal matters and more

- All members of an Insperity employee’s household are eligible for prepaid, professional counseling

- Most services are available at no cost

Professionally managed, low-cost plan that minimizes the burden of daily administration and compliance.

- Various eligibility options, 100% immediate vesting and flexible employer contributions

- Pretax and Roth contributions, automatic enrollment, and loans and in-service withdrawals

- With the Insperity 401(k) Plan, Insperity assumes the responsibilities and fiduciary obligations of plan sponsorship

- The Insperity 401(k) Plan undercuts average industry fees by 40-60%**

** According to comparisons with data provided by the 401k Averages Book. Data is licensed from the 401k Averages Book. All rights reserved. 401k Averages Book shall not be liable for any errors or delays in the content, or for any actions taken in reliance thereon.

We handle the benefits process,

start to finish

Carrier and plan

analysis

As the plan sponsor, Insperity negotiates contracts and manages vendor relationships to help ensure compliance, cost containment and stability.

Regulatory

compliance

Insperity keeps its benefits plans in compliance with all applicable laws.

Unparalleled

service

Benefits specialists are just a phone call away to answer employee questions. Or go online for 24/7 employee self-service with enrollment and decision-making tools.

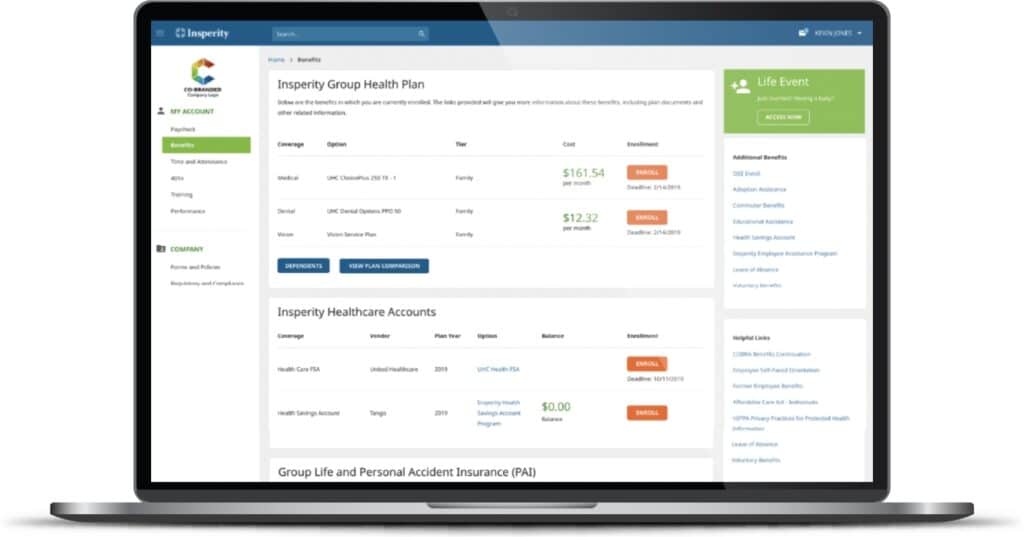

Enterprise benefits administration is easier with our HR technology

Employees can select and manage their benefits package all in one place using a self-service site.

Employees have access to virtual resources that can help with physical, emotional, social and professional health.

Links are available to access vision and medical claims information, prescriptions and how to find a doctor.

Employees can make midyear changes, access ID cards, connect with telemedicine or find answers to FAQs.

Employees can use a benefits planning tool to help determine the best coverage for them and their family.

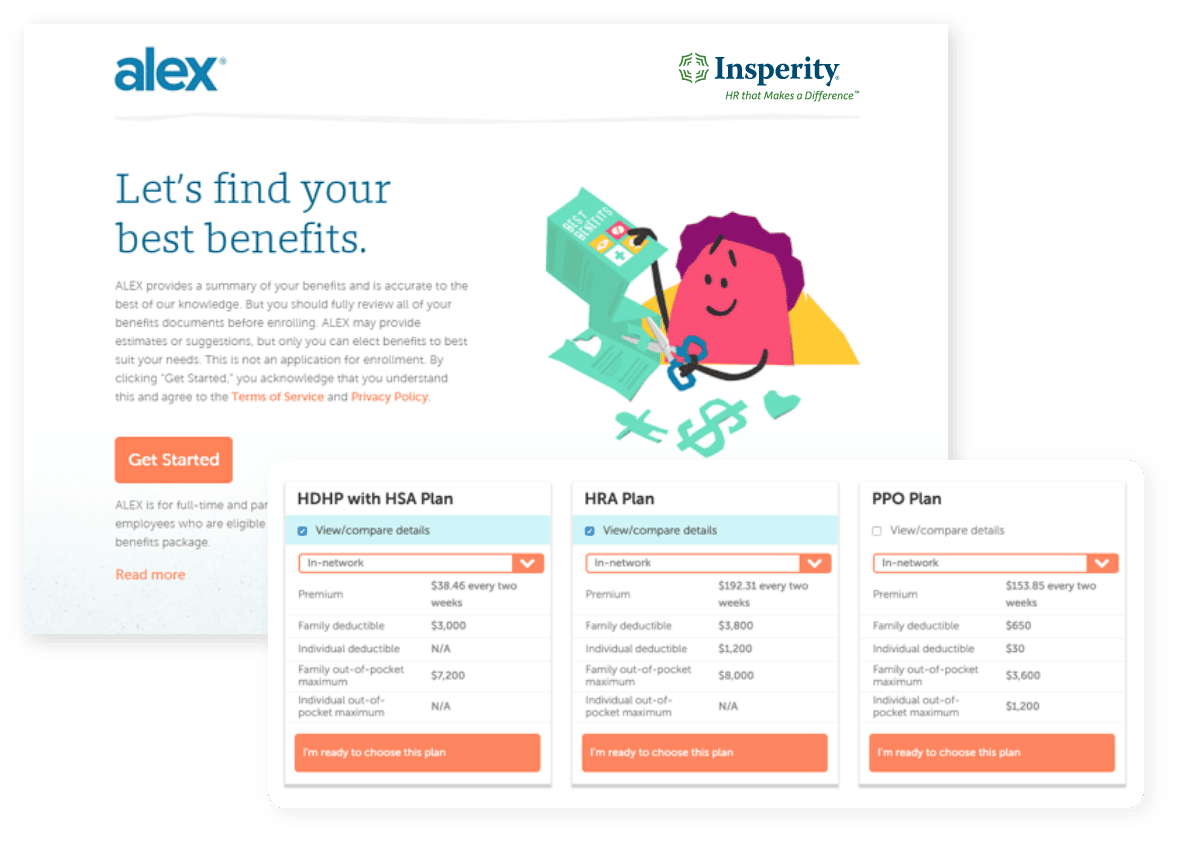

Meet ALEX – your employees’ new benefits BFF

ALEX is an interactive support tool on Insperity Premier™, our self-service HR technology platform, that helps simplify the benefits selection process for employees. Instead of wading through every possible option one by one, employees can lean on ALEX to help them quickly choose the plan that’s right for them.

By asking a series of questions, ALEX:

- Helps identify the option that may work well for employees and their families

- Takes only about 10 minutes, depending on the amount of guidance employees need

- Is available 24/7 during open enrollment on Insperity Premier™