Much conversation centered on the U.S. Equal Employment Opportunity Commission (EEOC) is devoted to high-profile, high-stakes topics such as preventing discrimination and harassment complaints or best practices for handling investigations once they’ve been initiated.

But what about more ongoing employer obligations with the EEOC, such as annual EEO-1 reporting? These often generate far less attention but are no less important.

What is EEO-1 reporting?

It’s a report submitted by employers that shows the racial and gender breakdown of their workforce. It’s mandated by Title VII of the Civil Rights Act of 1964 and the Equal Employment Opportunity Act of 1972, which prohibit employer discrimination on the basis of:

- Race

- Color

- Religion

- Sex

- National origin

The 1972 law empowers the EEOC to enforce provisions of the Civil Rights Act and take actions against violators, as well as collect data from employers.

Consider this your comprehensive introduction to EEO-1 reporting.

Information and data included in an EEO-1 report

Think of EEO-1 reporting as a snapshot of your employee headcount at a specific point in time. As an employer, you’re reporting to the EEOC how many employees you have within each EEOC-defined job category and where they fall along demographic lines; specifically, race and gender.

No information that identifies individual employees, such as names, appears on the report.

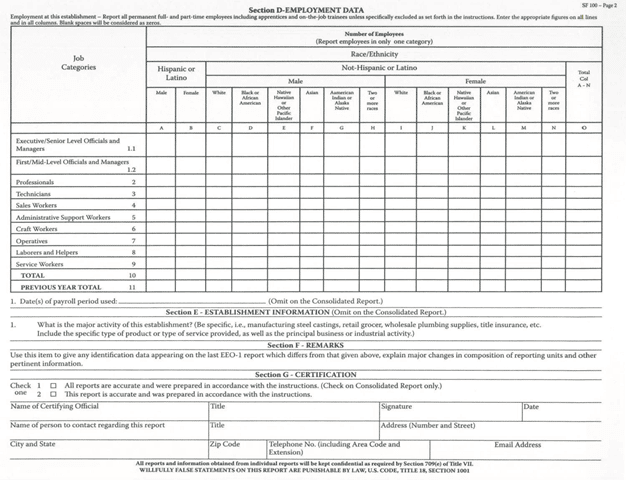

Instead, the reporting form looks like a grid, with EEOC-defined job categories listed vertically. Listed horizontally are the two genders: Male and female. Included within each gender category are the different races.

Now, you may wonder:

- What if the type of work my company performs tends to skew heavily toward one gender versus another?

- What if my company operates in an area that’s more demographically homogeneous?

- Does this look bad to the EEOC?

Be assured that EEO-1 reporting isn’t intended to be an indicator of whether your company is complying with federal anti-discrimination laws. Based on the information on the EEO-1 reporting form alone, it’s impossible to determine whether discrimination is taking place at a company.

Sample EEO-1 reporting form obtained from the EEOC website

Companies that should participate

The EEOC mandates that these companies comply with EEO-1 reporting:

- Any U.S. employer with 100 or more employees

- Any U.S. employer with 50 or more employees and a federal government contract worth at least $50,000

There is no clear rationale for why these companies have been singled out. These are simply the rules set forth by the EEOC.

If yours is a parent company with one or more subsidiary companies, you must combine the numbers of employees at each company to get a total number. If that total number is at least 100, the parent company must file an EEO-1 report for all subsidiary companies.

EEO-1 reporting only applies to company offices physically located within the United States. If an employer has offices in the U.S. along with some offices located elsewhere in the world, those offices outside the U.S. don’t have to report any employee data.

Furthermore, an EEO-1 reporting form should be submitted for each U.S. office location of a company. For example, if a company has six office locations throughout the U.S., then six separate forms should be submitted on behalf of the company.

The reporting process

In a typical year, the EEOC opens the EEO-1 reporting portal on its website on January 1. Reports for the previous calendar year are due on March 31 of the current year, meaning that the agency gives companies three months to gather and submit the requested information. Due to the COVID-19 pandemic, the reporting portal for 2019 and 2020 data will be open in April, 26 2021. The deadline for submitting the data is July 19, 2021.

The steps you’ll take:

- Select a single pay period between October 1 and December 31 of the calendar year for which you’re reporting. The specific pay period is your choice, as long as it falls within the months of October, November or December.

- Download data for all employees that were on your payroll during the pay period you selected. This excludes all 1099 contractors and temporary workers paid through a temporary agency. Only report employees being paid through the company’s payroll.

- Tabulate this information and ensure its accuracy.

- Log in to the EEO-1 reporting portal.

- Upload and submit your company’s form electronically. (A paper form is available, but the EEOC prefers online submission. You must request a paper form from the EEOC.)

Depending on your company and its size, it’s most often the human resources (HR) team that handles this task.

The complexity of this process depends on:

- How many U.S. locations your company has

- Whether you have subsidiary companies

- The nature of your workforce (regular, full-time employees versus temporary workers and contractors)

- Whether your company has software that can download this data from your company’s systems into a centralized place for review, convert it into a format in which it can be uploaded directly to the EEOC website and automatically populate it into the reporting form’s grid

Consequences of non-compliance

There are no financial or legal penalties for not participating in EEO-1 reporting when your company is required to do so. However, it’s in your company’s best long-term interests to comply with the federal government.

For example, if one of your employees or a third party submits a discrimination or harassment complaint about your company to the EEOC, one of the first things agency representatives will do as part of their investigation is to review your company’s EEO-1 report. Your company’s history of compliance and transparency could impact the outcome of current or future investigations.

Additionally, if your company is a federal government contractor, you could lose your contract by not submitting your company’s report by the deadline.

How PEOs can help

Company leaders have other important things to focus on besides administrative tasks: Running a business and keeping stakeholders happy.

Although it’s important to complete EEO-1 reporting accurately and on time, it’s still an annual obligation that can take time away from business goals.

Among the other critical benefits they provide, professional employer organizations (PEOs) make the EEO-1 reporting process convenient and hassle free – granting you peace of mind that government compliance activities are taken care of.

Other ways in which PEOs help with EEO-1 reporting:

- Clarifying whether your company meets EEOC criteria for participating

- Automatically downloading and verifying the accuracy of all employee data

- Submitting data on your behalf

- Significantly reducing (or eliminating) your work hours dedicated to this task

- Relieving your company from the burden of investing in EEO-1 reporting software

Summing it all up

EEO-1 reporting is an important annual activity mandated by the EEOC for certain companies. It requires qualifying employers to report the gender and racial composition of their workforce. This information is submitted – usually online – by March 31 of each year.

Although there are no financial or legal penalties for non-compliance, it’s a best practice for companies to cooperate. PEOs can assume responsibility for this task to make government reporting and compliance more efficient and free of hassles and errors.

To learn more about the ins and outs of regulatory compliance, download our free e-book HR compliance: Are you putting your business at risk?