Change is inevitable. Managing change in the workplace is an everyday responsibility for business owners and managers.

Often, change is predictable or planned well in advance, such as:

- Implementation of a new system or technology

- Introduction of a new office policy

- Moving to a new office

- Mergers and acquisitions

- Modification to senior leadership

- Reorganization of staff

- Retirement of a top-performing, highly valued employee

These are all evolutions in a business for which you usually have ample time to prepare and get your employees on board.

But what about the changes you don’t see coming?

What about those times when you are caught completely by surprise – and not at all in a good way? How can you anticipate the unknown? How can you fix these types of problems and, better yet, protect yourself against them in the first place?

As challenging as it can be to prepare for the what if, the cost of not doing so can be high. Without a plan for managing unexpected change in your workplace, crises can turn into catastrophe. The results can be dire:

- Revenue loss up to bankruptcy

- Critical skill gaps in your workforce

- Diminished reputation

- Negative relationship with employees or customers

- Inability to maintain regular operations

Change may be inevitable, but the damage inflicted by unexpected events doesn’t have to be.

General tips for managing change in the workplace

Change can be distressing for any worker. That’s especially so when it’s abrupt and unexpected.

You can lessen the pain planning ahead.

1. Acknowledge the change curve.

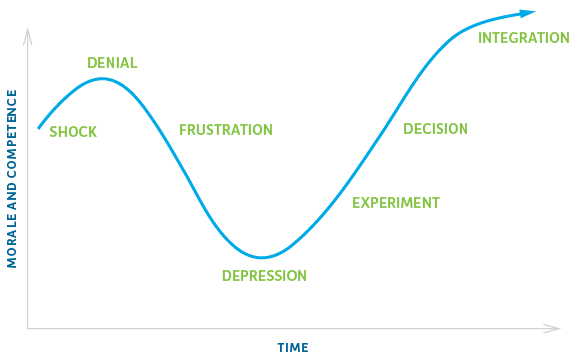

For business owners and managers, the change curve is beneficial to understanding the emotions commonly experienced when processing sudden changes.

It’s important for everyone at your company to acknowledge their feelings so they can then move forward through each phase of the change curve and reach acceptance as soon as possible.

It’s OK and natural for people to resist change initially, and they should not feel guilty or be penalized for it.

2. Perform a SWOT analysis.

Continually engage in a SWOT analysis of your business. SWOT means:

- Strengths

- Weaknesses

- Opportunities

- Threats

You’ll want to work on all four areas, including weaknesses and potential threats in your analysis, because it’s in these categories that unexpected changes typically originate and can spin out of control.

Weaknesses tend to be internal issues, while threats are derived from external sources. Your goal is to identify where your business is most vulnerable, and how you can best address those vulnerabilities.

As you ponder potential scenarios, consider how likely each event is to happen and develop effective response strategies, so you aren’t blindsided when unexpected event hits.

3. Plan your communications and first steps.

Of course, it’s difficult to prepare for an event that hasn’t happened yet and when you’re not entirely sure what that event could look like. But that’s no excuse to not plan, on a broad level, what your response could be to a variety of unexpected changes.

Here’s how:

- Prepare internal and external communications in response to specific events, such as templates for an email or initial announcement.

- Write out the message that should go to those who are impacted (clients, employees) and establish the process for how the communication will be distributed.

- Then consider what other initial steps you would take to control the situation.

What are some examples of what you could be up against?

Common scenarios of unexpected change and ideas to prepare for them

Office damage (natural disasters and vandalism)

Unfortunately, we can’t control the weather or absolutely prevent criminal activity. And when events such as fire, flood, tornado, hail or some form of vandalism happen, the damage left behind and the ensuing chaos can bring your business to a screeching halt.

Before disaster ever strikes, you need to have established a disaster-readiness plan that addresses critical points:

- Emergency preparedness (notification system, evacuation routes, meeting points, safety protocols and designated leaders)

- Facilitation of employees’ temporary working arrangements

- Communication with employees and customers about the status of your business

- How to get your business up and running again

This damage can be financially crippling if you’re not prepared. That’s why you should also have property insurance so you can rebuild your office space with minimal financial stress and disruption to regular operations.

A “business interruption” add-on to your insurance policy can even reimburse you for lost income related to property damage. It could be the difference between staying in business or bankruptcy.

Loss of critical personnel

Has another company – worse yet, a competitor – ever wooed away one of your most valued team members with an exciting promotion, higher salary or better benefits package?

Have any of your employees – including senior-level leadership – had a sudden family or medical emergency and had to take an extended leave?

If it hasn’t happened yet, it’s a question of when, not if.

Here’s how you can minimize the sting of unexpectedly losing a valued person on your team and ensure that your business continues functioning normally:

- Leverage retention strategies, including encouraging a healthy work-life balance and creating a desirable workplace culture.

- Proactively identify who are your strongest, most important players, and what critical skill and knowledge gaps would exist in their absence.

- Have job descriptions ready to go so your recruiters can immediately start the hiring process.

- Maintain awareness of what your employees are working on and which processes they follow to complete their work. No one should work in a silo without anyone knowing what they’re doing.

- Establish a succession plan.

- Know what you will communicate to clients with whom now-absent employees worked closely.

Understand that these clients may have had a solid relationship with these employees and may feel more loyalty to them than your company. You’ll need to work to gain their trust and assure them that the same quality of service will continue unimpeded. You’ll also need to introduce them to their new contacts at your office and explain any new processes. - Consider obtaining a key-person life insurance policy in the event of the premature death of your CEO, founder or any other team member who is essential to the continued success of your company.

Loss of key client

Losing a valued employee is easily matched by a major client severing business ties – especially when it’s to work with a competitor. Here’s how you can prevent this:

- Coach your team members to deliver outstanding customer service.

- Maintain strong relationships with clients. Let them know how appreciated and valued they are.

- Stay apprised of what your competitors offer their clients. How can you ensure that your business is more attractive?

- Network continually with new prospective clients. Unfortunately, business relationships evolve over time and nothing is permanent. Sometimes things happen due to circumstances beyond your control.

If you become complacent with your existing client roster, you’ll be in trouble when change inevitably happens. Always be on the lookout for new opportunities so the financial health of your business isn’t dependent on a few clients.

Data breach or cybersecurity issue

It’s an increasingly common dilemma for businesses. How do you protect the data of employees and customers, as well as safeguard valuable intellectual property?

Think of all the sensitive information your business has:

- Social Security numbers

- Credit card numbers

- Salaries

- Medical and retirement account data

- Details about your company’s trademarked or patented products

If this sensitive information fell into the wrong hands it can be devastating for all parties. It can put you at risk for financial losses and expose your business to significant liability.

You need to build a data protection policy to prevent these scenarios from happening at all, but also to serve as a guide on what to do should a data breach occur. Also, consider hiring an IT consultant who can assess your systems and, if necessary, enhance your security barriers and protocols.

You can also secure cyber liability insurance in the event you are sued, penalized or lose business.

Workplace violence

Whether it’s physical assault, verbal abuse, armed robbery or the dreaded, news-dominating active shootings, workplace safety should be top of mind. After all, no public place is immune from these dangers.

Conduct a safety assessment of your office and take necessary steps to ensure that your workplace is as safe as possible. Then establish a plan for how your business will recover and how you will communicate with your employees and customers if the unthinkable happens.

Change in laws or regulations

Difficult though it may be to keep up, governments have the power to completely upend how you do business.

Legislative or regulatory changes really shouldn’t be a surprise because they’re usually months in the making. But if you’re busy running a business, it can be challenging to maintain awareness about in-progress legislation in the U.S. Congress or in your state legislature. This task becomes even more complex and time-consuming if you do business in multiple cities or states.

In this ever-changing landscape, how can you become educated about potential laws in the works and remain in compliance?

Try to stay well-versed in the latest employment and labor laws and regulations impacting your business. Depending on the type of business you have, you may want to also consider hiring a lobbying firm to advocate on your behalf for favorable legislative outcomes.

Summing it all up

There are an endless number of unforeseen hazards that could impact your business. While it’s impossible to plan for every scenario, there are steps you can and should take to lessen the impact of sudden change.

If you’d like more information on how managing unexpected change in the workplace, download our complimentary magazine: The Insperity guide to managing change.