Are you required to E-Verify your new hires, or just interested in adding this step to your onboarding process to ensure you have a legal workforce?

Better yet, what is E-Verify? And how does it work?

Here’s the need-to-know information about how E-Verify works for employers, including:

- E-Verify basics

- Reasons employers use it

- Enrolling in the program

- The verification process

- Using an employer agent

What is E-Verify?

E-Verify is a free, online system that quickly compares the information your new employees provide on their I-9 forms to the records on file in the Department of Homeland Security and Social Security Administration.

E-Verify confirms whether the people you’re hiring are authorized to work in the United States.

In general, using E-Verify protects you as an employer because it shows you’ve done your due diligence. If you’ve collected I-9 forms and put your employees through E-Verify successfully, then you’ve done everything you could be expected to do to ensure you have a legal workforce.

Three reasons to E-Verify employees

While every employer can benefit from the protection provided by using the E-Verify system, not every organization will find it necessary, unless:

- You’re in a state that requires E-Verify.

- You’re contractually obligated.

- You could possibly hire someone who isn’t eligible to work in the U.S.

1. State or local laws

Some states require all employers (or all above a certain size) to E-Verify new hires. For example, E-Verify requirements affect most employers in:

- Alabama

- Arizona

- Georgia

- Louisiana

- Mississippi

- Missouri

- North Carolina

- South Carolina

- Tennessee

- Utah

Other states only require certain types of employers to use E-Verify, such as public employers and contractors.

For example, in Texas, all state agencies and higher education institutions must use E-Verify, and all state contractors and sub-contractors must enroll to qualify for public contracts.

These regulations are subject to change, so you should regularly monitor legislation in the states where you have employees.

2. Contractual obligations

Since 2009, all federal contractors and their subcontractors (paid over $3,000) have been required to use E-Verify to confirm that their new hires and all existing employees working directly on federal contracts are authorized to work in the US.

Even if you’re not a federal contractor, you may have a private contract to provide services that requires you to verify the employment eligibility of your workforce, and E-Verify is the primary way to do that.

3. Employing non-U.S. citizens

Perhaps you’re an employer that wants to hire and sponsor students on academic visas seeking an extension of their optional practical training under a STEM-designated degree program. In this case, you’re legally required to use E-Verify.

You may also choose to use E-Verify to confirm work eligibility even when not otherwise required to do so as long as you do not use E-Verify selectively but use it for all employees.

If you have mistakenly hired someone who wasn’t authorized to work in the U.S. in the past, the E-Verify program can help you avoid that in the future.

Registering for E-Verify

Before you can begin using E-Verify, you must register as an employer online and agree to the program rules.

When you enroll, you’ll need to:

- Provide some basic information about your company, including your Federal Tax ID number, the hiring locations where you’ll use E-Verify and the total number of employees at those sites

- Indicate if you’re a federal contractor

- Sign the E-Verify memorandum of understanding (MOU)

- Choose at least one program administrator

If you’re using an employer agent to manage your E-Verify process (see below), they will complete the enrollment step on your behalf.

How the E-Verify process works

Once enrolled, here’s how to E-Verify employees.

1. Begin with completed I-9 forms.

Don’t jump the gun – I-9 forms must be completed before E-Verify and no later than three business days after an employee begins working for pay.

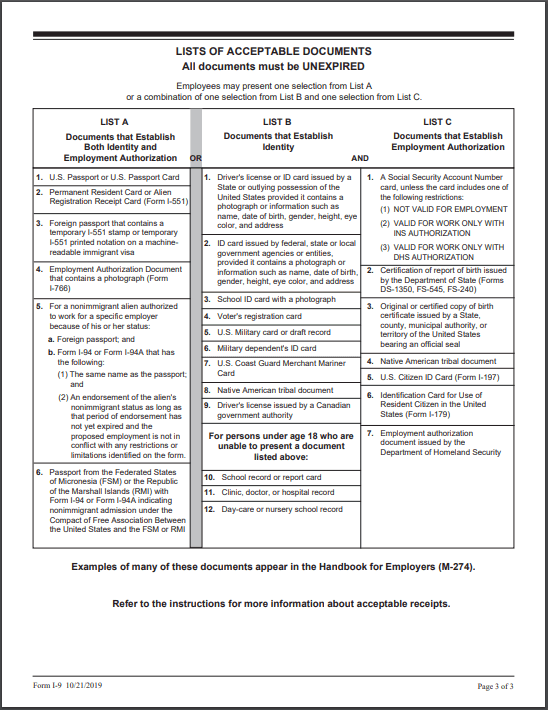

To complete their I-9, your employees must also present you with supporting documents chosen from the three lists of acceptable documents included on the last page of the I-9 form.

- List A – documents that establish both identity and employment authorization (e.g., U.S. Passport)

- List B – documents that establish identity (e.g., driver’s license)

- List C – documents that establish employment authorization (e.g, birth certificate)

To meet the requirements of the I-9, new hires can give you one document from List A or a combination of one from List B and one from List C.

As an employer, you may not request specific documents. As long as they appear genuine, unexpired and related to your employees, you must accept any documents they choose to provide. Dictating which documentation they should submit can be considered discrimination.

One important exception to note: If an employee presents List B documents, they must include a photograph.

Make a copy of these supporting documents and keep them on file with employees’ I-9s.

The I-9 comes first, and then E-Verify is your final step in the process of confirming that your workforce is legal and authorized to work in the U.S.

2. Create a case in E-Verify.

Next, you create a case in E-Verify using the information you collected on your employee’s I-9. Again, you have to start the E-Verify case no later than the third business day after an employee starts working for pay.

3. Compare photos, if applicable.

Photo matching is an important part of the verification process.

In this step you must verify that the photo displayed in E-Verify is identical to the photo on the document your employee presented for section 2 of the I-9 form.

Photos should always be compared to those in the document presented and not just with the face of the employee.

Some photos, like driver’s licenses, will not trigger photo matching in E-Verify. Other documents will always prompt you to compare photos, specifically:

- Permanent Resident Cards (Form I-551)

- Employment Authorization Documents (Form I-766)

- U.S. passports

If you didn’t keep a copy of an employee’s supporting documents and can’t confirm the photo match in E-Verify, your employee will receive a “Tentative Nonconfirmation” (TNC) result and must be given the opportunity to correct the problem.

4. View the case results.

With E-verify, you’ll know instantly whether your employees are “Employment Authorized.” Should their information be invalid or incomplete, you’ll also be notified immediately.

If the system determines that a manual review of records is necessary, you’ll receive a “Verification In Process” response, and verification results are returned within 24 to 48 hours.

Occasionally, however, the information from an employee’s I-9 doesn’t match government records. In these cases, E-Verify will display a TNC result.

A TNC doesn’t mean that your employee isn’t eligible to work in the U.S. or is an undocumented noncitizen.

If you receive a TNC result, the notice will explain the cause of the mismatch. Your employee has eight federal business days to resolve the situation, and you must allow him or her to continue working until you receive a final result from E-Verify.

No further action is required from the employer at this point. In fact, employers may not take action based on a TNC unless a “Final Nonconfirmation” notice is received.

“Final Nonconfirmation” means that E-Verify cannot confirm employment eligibility after the employee took additional action.

5. Close the case, if needed.

E-Verify automatically closes “Employment Authorized” cases for employers.

If you get a “Close Case and Resubmit” or “Final Nonconfirmation” result, you must manually close the case to complete the E-Verify process.

Four things employers should know about E-Verify

Here are some other important points for employers getting started with E-Verify.

- Once you enroll a company location for E-Verify, then you must E-Verify all new hires at that location going forward.

- You can’t E-Verify existing employees unless your federal contract requires it.

- You must provide notice to prospective employees who will have their employment eligibility verified by:

- Displaying an E-Verify participation poster in English and Spanish

- Or ensuring all prospective employees receive notice with their application materials

- Most E-Verify issues are resolvable after a TNC.

Doing E-Verify yourself vs. using an employer agent

The E-Verify program is free and easy-to-use according to the government, yet not all employers choose to navigate the E-Verify process themselves.

There are two main reasons you might hire an employer agent:

1. You don’t want to spend time on the training requirements.

Before you can create cases in E-Verify as an employer, you must complete training tutorials to help ensure program compliance. The training modules are usually an hour long and must be repeated when E-Verify updates them significantly. If you use an employer agent, it’s their responsibility to complete these trainings.

2. You don’t have anyone available to serve as program administrator.

As noted above, your new hires’ E-Verify cases must be created within three business days of their start date. This means you can’t just do E-Verify once a month for recent hires. Someone who’s trained and who knows how to E-Verify employees must be available at all times. For many companies, it makes sense to assign this responsibility to an employer agent.

If you choose to use a business provider of E-Verify services, be sure you select one that offers you more than just a portal into the E-Verify system (where you’ll still have to do all the data entry work).

Look for a provider that accepts your I-9 forms and takes care of submitting, tracking and providing you the information you need regarding the process.

Minimizing risks

By understanding “What is E-Verify?” and why you might want to (or be required to) incorporate it into your business, you can better avoid hiring mistakes that expose you to liability and damage your credibility as an employer. Ignoring labor and employment laws can be costly for your business.

To better identify your liabilities, download our free e-book: HR compliance: Are you putting your business at risk?